Tax deductions & credits affected in 2018 by inflation

Millions of taxpayers depend each year on tax deductions and tax credits to cut their annual tax bills. The main tax …

Accounting, Tax, and CPA Services

Millions of taxpayers depend each year on tax deductions and tax credits to cut their annual tax bills. The main tax …

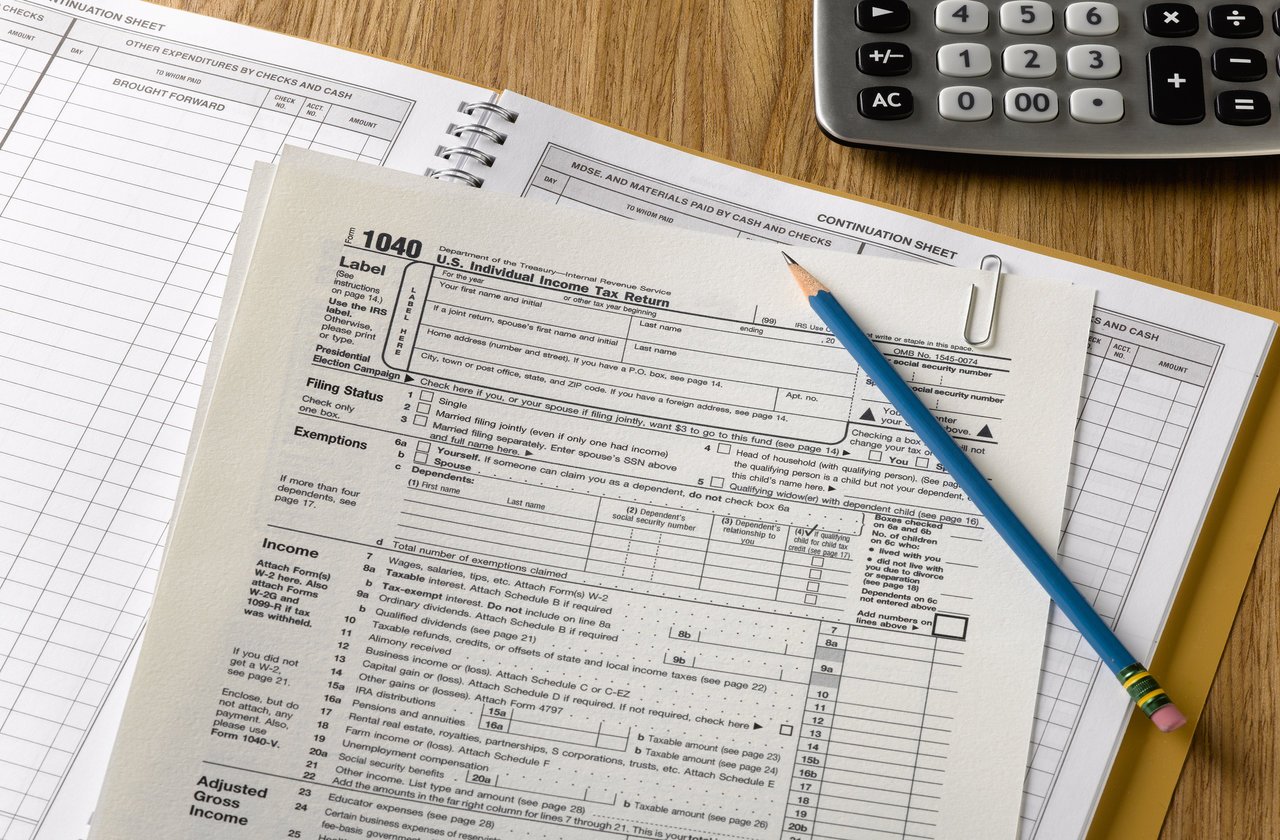

Where the heck has 2017 gone? Dec. 31 [is] the deadline for most moves that could affect this year’s taxes. The …

To err on tax returns is human. To forgive is Xtraordinary, and yes, the misspelling is intentional. Tax law lets us correct …

[Friday the 13th is] a terrible day if you’re superstitious or suffer from paraskevidekatriaphobia. And making things …

Based on Internal Revenue Service tax return filing data, it looks like around 7 million Americans have yet to submit their …

Human error, specifically one human’s error, is why 145 million of us are worrying about what crooks will do with the …

One thing is true when it comes to tax law changes. Some people win and some people lose. The big question as we await the …

It seems a bit too little, too late, but the Internal Revenue Service is continuing its efforts to make it harder for …

One of the major drivers of the latest federal tax reform effort is the corporate tax rate. The Trump Administration is still …

Most of the time, younger — and that’s definitely a relative term — folk think of grandparents as ancient. In many …

Maybe you didn’t think the hurricane’s flood waters would reach your neighborhood. Or maybe you just never kept …

Among the things to think about as fall nears is, of course, taxes. Here are four quick tax tasks to consider this month. …

Many baby boomers have to support aging parents, adding to the struggle of saving enough for retirement. Here are six steps …

Intelligent automation (IA) is getting the attention of finance teams, operational environment leaders, and shared service …

It’s easy to let the financial side of our career fall to the bottom of our priority list. It’s not a favourite task for most …

Unless you have spent years studying bookkeeping and accounting, looking at financial statements probably makes your eyes …

When it comes to building your nest egg, you have more options than you may think. One such savings vehicle is only getting …

Without a comprehensive tax strategy in place, many retirees may pay three times more in taxes than they need to. Avoid that …

For small-business owners (and their employees) SIMPLE IRAs can be a slam-dunk at tax time. Source: A ‘Simple’ Idea to Save …

With a cursory knowledge of wills, trusts, powers of attorney and Medicaid, you can help clients and their families plan …

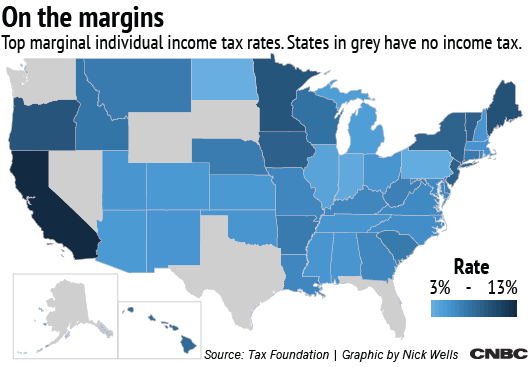

Several states made significant changes to income tax this summer, in some cases in political showdowns that left revenue …

Happy July 5th, the start of midyear tax planning. With six months left in the tax year, it’s the perfect time to make …

Early withdrawal penalties make where to put your nest egg a critical decision if you want to stop working in your 40s and …

On June 14, I testified before the Senate Small Business and Entrepreneurship Committee on how tax reform might affect small …